| Summary: | Hi Sanjay, During the budget announcement last year, SRT & ECAL were removed so FRCS has launched a new output file based on the new table settings we have. We need to get the new file format out so that clients can lodge PAYE successfully. This change is under the following menu: Payroll Processing> Tax Submission>

Step 1 - Update of Tax Table - ( User Maintained as per our instructions) Chargeable Income ($) | Resident Individual | Non-Resident Individual | Income Tax ($) | Income Tax ($) | 0 – 30,000 | Nil | 20% of excess over $0 | 30,001 – 50,000 | 18% of excess over $30,000 | $6,000 + 20% of excess over $30,000 | 50,001 – 270,000 | $3,600 + 20% of excess over $50,000 | $10,000 + 20% of excess over $50,000 | 270,001-300,000 | $47,600 + 33% of excess over $270,000 | $54,000 + 33% of excess over $270,000 | 300,001-350,000 | $57,500 + 34% of excess over $300,000 | $63,900 + 34% of excess over $300,000 | 350,001- 400,000 | $74,500 + 35% of excess over $350,000 | $80,900 + 35% of excess over $350,000 | 400,001- 450,000 | $92,000 + 36% of excess over $400,000 | $98,400 + 36% of excess over $400,000 | 450,001- 500,000 | $110,000 + 37% of excess over $450,000 | $116,400 + 37% of excess over $450,000 | 500,001 – 1,000,000 | $128,500 + 38% of excess over $500,000 | $134,900 + 38% of excess over $500,000 | 1,000,001 + | $318,500 + 39% of excess over $1,000,000 | $324,900 + 39% of excess over $1,000,000 |

Step 2 - 2024-Paye_Reg 6-Template - (Users use this table to identify if the software is making the right calculations as per the table in Step 1. Note: This is just a guide for us to use to ensure we are properly in compliance with the PAYE deductions. Step 3: PAYE out Put File (This needs to be actioned from our end and applied to all Customer sites) - Pay Day Reporting Manual Template - Refer Attached

- Pay Day Reporting Template 2024 (Auto) - Refer Attached

Let me know if you need any other details. Sitla.

|

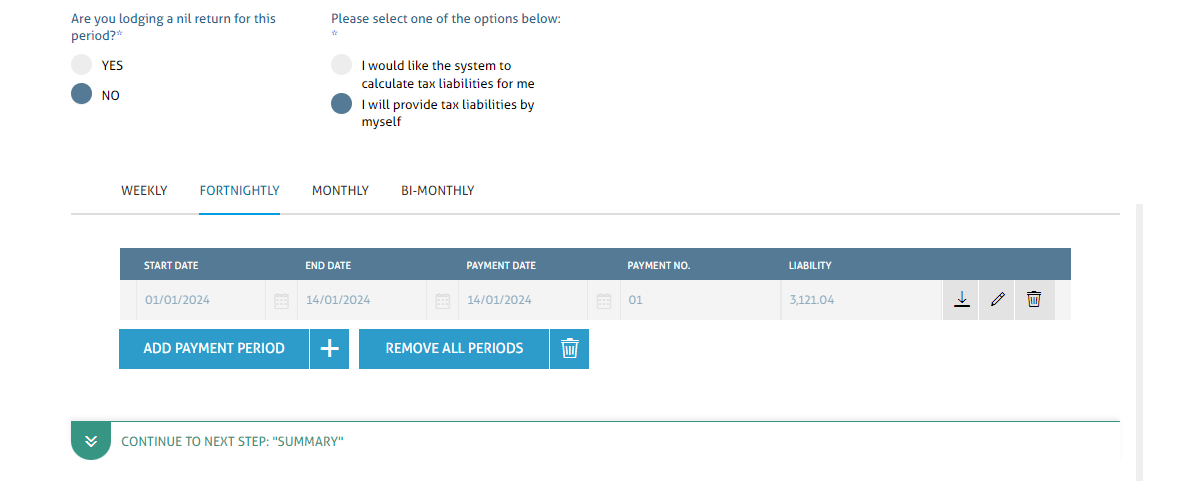

| Hi Sanjay, As discussed, I have attached the comparison file for both MAnula and Auto calculation on the payday reporting format. Change is simple, just remove the 4 fields from Manual and 2 fields from Auto format. I have removed the extra field columns from existing files to match with the 2024 file format and uploaded them for both formats and it was successfully accepted but the FRCS portal. Figure 1: Manual Format

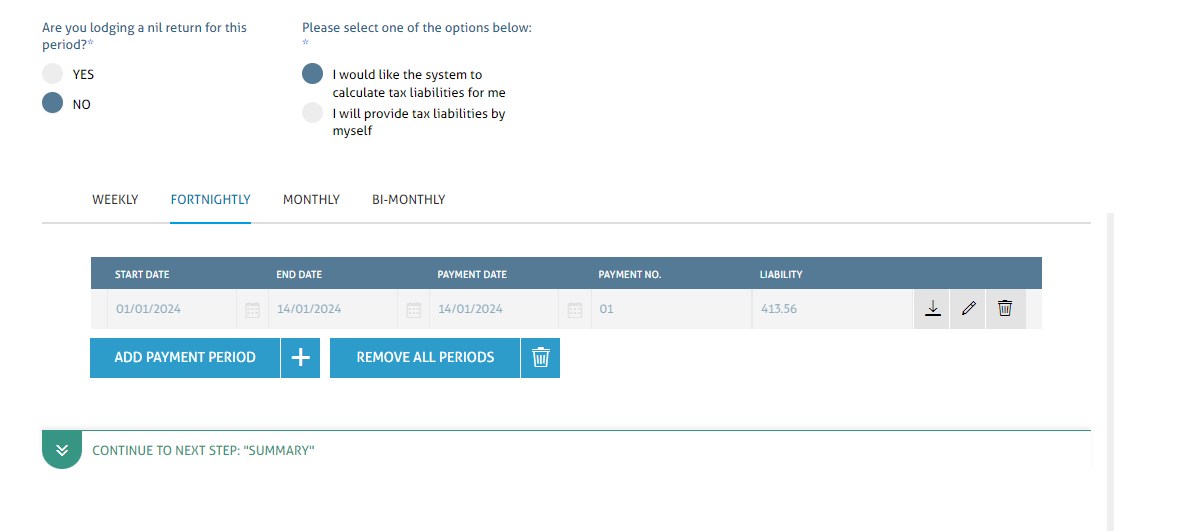

Figure 2: Auto Pay Day Format

Transfering this case to development. Sitla. |

| PART A - Development work for this case has been completed. 1. The change will be available in version: 15.20 2. The following changes were made (Include Database object names, Program classes, and any other relevant information): - Added two options for Pay Day Reporting, PayDayManual2024 and PayDayAuto2024

3. Affected Areas: - Tax File Submission

4. The issue was caused by: - Legislation Change

5. Other Relevant Notes:

6. Next Step (Review and System Test (Developer) -> UAT (Quality) -> Documentation): UAT

PART B - Development Reference (Place descriptor for objects changed):

Figure 1 - Integration for Pay Reporting - Added Options

Figure 2 - Pay Day Reporting Formats available in "Tax File Submissions

|