| Subject: | Variance in Tax Calculations between LinkSOFT and FRCS Template |

| Summary: | Variance in Tax Calculations between LinkSOFT and FRCS Template |

| Audit Notes: | Edited by sanjay on 26/09/22 13:34. Edited by sanjay on 22/08/22 16:30. |

| 11 Aug 2022 | 08:16AM Comment 1 by Vineshwar Prasad (Edge Business Solutions) Assigned To: Vineshwar Prasad (Edge Business Solutions) Followup Date: 12-08-2022 08:13 AM Time Taken: 6.00 Notes: ETC extended from: 12/08/2022 to 12/08/2022 |

| Environment Details;- Hosted on https://www.linktechnologies.com.au/LinkSOFT-JacksRetail

- Company: 1002

- Emp ID: E0364

Tasks; - Created Weekly Pays from Jan 22 to July 222

- Updated the FRCS template with the system Values

- Created Pay for August 22 - SRT does not balance

|

|

| 11 Aug 2022 | 02:23PM Comment 2 by Sanjay (Link Technologies) Assigned To: Vineshwar Prasad (Edge Business Solutions) Followup Date: 12-08-2022 02:17 PM Time Taken: 1.00 |

| Discussion with Vineshwar and Sanjay - Create this scenario in https://www.linktechnologies.com.au/DEMO-LinkSOFT-EDGE and schedule a time ASAP with sanjay to go through this calculation.

- Place the current calculated values and the correct value in this case.

|

|

| 12 Aug 2022 | 10:21AM Comment 3 by Vineshwar Prasad (Edge Business Solutions) Assigned To: Vineshwar Prasad (Edge Business Solutions) Followup Date: 16-08-2022 09:54 AM Time Taken: 3.00 Notes: ETC extended from: 12/08/2022 to 16/08/2022 |

| Environment Details; - Hosted on https://linktechnologies.com.au/DEMO-LinkSOFT-EDGE

- Company: 1003

Tested as below; - Created 3 Employees

- Emp ID: EK001, EK002, EK003

- Salary: $350,000

- Pay Team: Monthly

- First Pay: Jan 2022

- Created Pay No 1: January 22

- Created Pay No 2: February 22

- EMP EK001 - No changes to Tax

- EMP EK002 - Increased PAYE, SRL, and ECAL by $200

- EMP EK003 - Decreased PAYE, SRL, and ECAL by $200

- Created Pay No 3: March 22

- EMP EK001 - No changes to Tax

- EMP EK002 - Increased PAYE, SRL, and ECAL by $200

- EMP EK003 - Decreased PAYE, SRL, and ECAL by $200

- Note: Pay No 3 - Taxes were correctly adjusted in LinkSOFT and FRCS Tax calculator after the above changes

- Disabled ECAL Tax Table in LinkSOFT

- Created Pay No 4: April 22

- EMP EK001 - All Taxes balanced

- EMP EK002 - Taxes not balanced

- EMP EK003 - Taxes not balanced

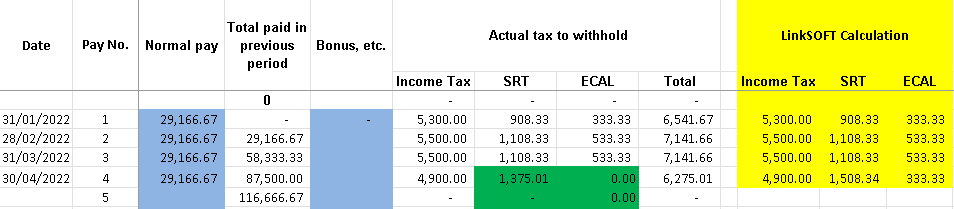

Image 1: FRCS Tax Calculator: EMP EK001

.PNG)

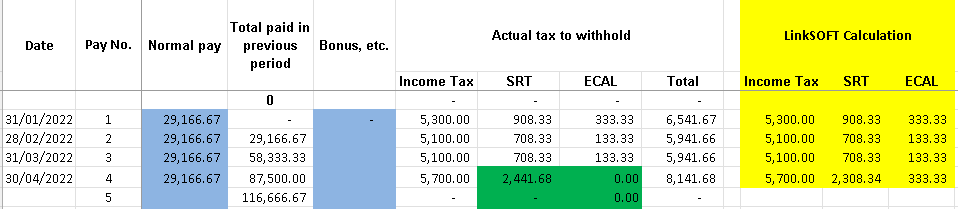

Image 2: FRCS Tax Calculator: EMP EK002

Image 3: FRCS Tax Calculator: EMP EK003 Notes: - PAYE Calculations are correct on every Pay

- ECAL is still being calculated on Pay No 4 even after it has been disabled

- SRL & ECAL does not balance on Pay No 4

|

|

| 22 Aug 2022 | 04:30PM Comment 4 by Sanjay (Link Technologies) Case L12777 added to project 14.10 |

| 23 Aug 2022 | 01:54PM Comment 5 by Sanjay (Link Technologies) Assigned To: Vineshwar Prasad (Edge Business Solutions) Followup Date: 23-08-2022 07:50 PM Time Taken: 5.00 |

| Hi Vineshwar, To remove ECAL Tax, you need to do the following: - Remove "FJECAL" from Menu "Employee Maintenance ~> Employee Additional Tax"

- Rebuild Standard Pay in Menu "Employee Pay Setup"

THis should exclude FJECAL from tax calculations. I will close this case for now. Let me know if you have any further issues. |

|